TSMC is the world’s largest foundry with a market share of 65 % -67 %. The Samsung Foundry is a remote thanks to the low yields he has achieved on advanced chip manufacture. This makes it more expensive for Samsung consumers to use foundry instead of TSMC because low production means that low chips can be produced at the same price. This is the reason why Qualcomm dropped the Samsung Foundry in 2022. At the time, the Samsung Foundry Snapdragon was producing 8 General 1 and allegedly had 35 % of it. At that time TSMC’s 4NM production rate was 70 %.

Samsung Foundry Production Problems moved to TSMC from Samsung to TSMC

As a result, Qualcomm picked up all his marble from the Samsung playground and moved them to the TSMC. The latter created a slightly re -created Snapdragon 8+ General 1 and has since developed all the flagship Snapdragon application processors of Qualcomm. It cannot be denied that Taiwan -based chip foundry has a star -studded list of clients that include high names of tech names, including Apple, AMD, N Vidia, Medetic, Qualcomm, and more.

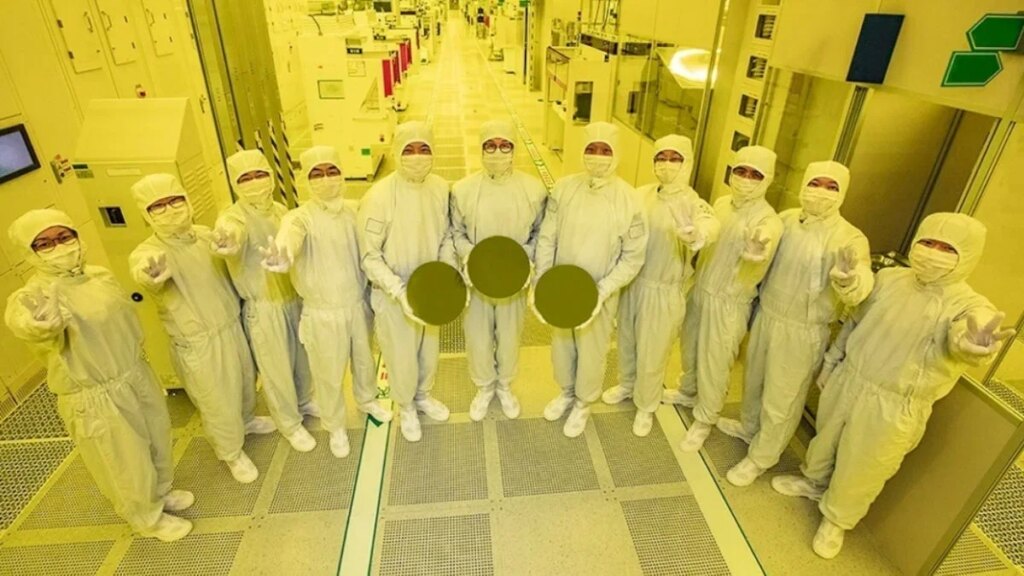

Thanks to the poor production of the Samsung Foundry, Qualcomm converted to TSMC to make Snapdragon 8+ General 1. Image Credit-Franina

The Samsung Foundry may catch a break if it can improve production in the production of Samsung’s own Xinos 2600 application processor, which will be made on the 2NM process node of the foundry. If the Samsung Foundry can achieve its output substantially to ensure the preparation of the number of Samsung needs, the Acneos 2600 Galaxy will give strength to the S26 and Galaxy S26+ In most markets and they will become the first smartphone to hold the model 2NM application processor.

Generally, the iPhone has been the device that welcomes the next cutting edge process node. But next year, if Samsung plays his cards properly, this honor belongs to him Galaxy S26 And Galaxy S26+. Ironically, the Galaxy S26 ultra, which is the top -off line model, will be powered by 3NM Snapdragon 8 Elite 2 for the galaxy and will not be included in any record -breaking historical moments. It is believed that his foundry is looking for spin or sale. Unless a contract can be made according to his choice, Samsung hopes that TSMC users will generate maximum income for the unit by trying to persuade users to switch to the Samsung Foundry. The latter hired a former TSMC executive earlier this year, and a report outside Korea states that Samsung is ready to pay a maximum of $ 300,000 for professionals to join the Samsung Foundry’s sales team in the United States.

TSMC has begun mass production of 4nm chips from its Arizona Fab

Both Samsung and TSMC have made US fibers and TSMC has started producing 4NM chips in Arizona and will produce 2NM ingredients in 2028. Samsung’s timeline is ahead of TSMC in states. In Taylor, Texas, the Samsung Foundry will produce large 2NM chips in 2026. Samsung needs a strong order flow to keep Taylor, Texas Line Humming, which will disconnect modern chips. This is why the Samsung Foundry will pay maximum, 000 300,000 to the California -based salesmen.

Foundry sales director can earn a maximum of $ 319,800 and a senior manager within the Foundry’s Customer Service Unit, paying a salary of $ 180,950 to $ 289,050. Samsung’s salaries are ready to pay the top of the United States, which he is paying for the same jobs in South Korea.

The new rent will be to increase the market share of the Samsung Foundry in the United States. Some TSMC users in Taiwan will also supply chips built in the United States, including Apple, AMD, NVIDIA, and Qualcomm. TSMC is already sending 4NM chips from its Arizona Fab to Apple and Navidia. The semiconductors built in Arizona will not face any revenue that is part of the appeal to buy domestic -made chips.

Depending on what report you read, the third largest foundry globally is China’s SMIC. The latter produces chips made by Huawei and is the country’s largest foundry.

Hold on to the Surfers VPN now at a distance of more than 50 % and with 3 additional months!

Save your connection now at the expense of deals!

We can earn commission if you make purchases

Check the offer

Read the latest from Alan Fredman